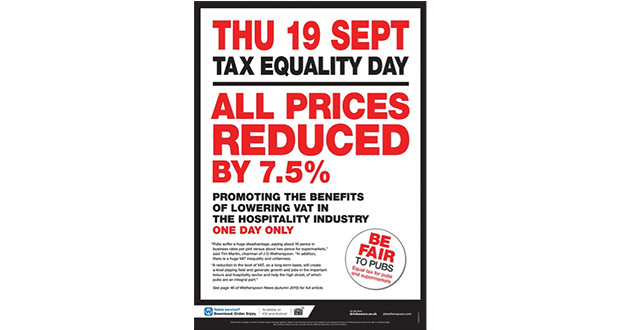

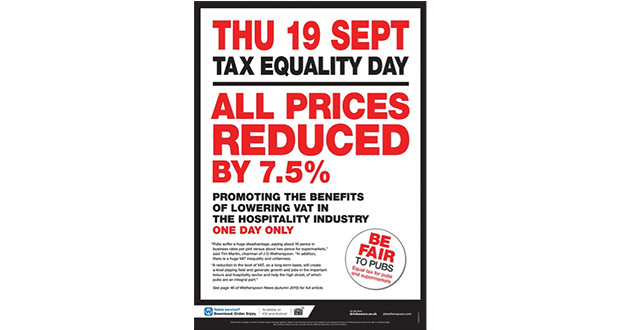

Wetherspoon Pubs To Reduce Prices On Tax Equality Day

Wetherspoon pubs will be cutting the price of all food and drink by 7.5 per cent on Thursday September 19.

Wetherspoon pubs will be cutting the price of all food and drink by 7.5 per cent on Thursday September 19.

The company’s pubs in England, Wales, Scotland and Northern Ireland are hosting a Tax Equality Day, aimed at highlighting the benefit of a VAT reduction in the hospitality industry.

Prices at each of the company’s pubs (not including those in the Republic of Ireland) will be reduced for one day only.

So, for example, the total price of a meal and drink for an individual will be reduced from £10 to £9.25 on the day.

In Scotland, prices will be reduced on all food, soft and non-alcoholic drinks and hot drinks.

At present all food and drink in pubs is subject to 20 per cent VAT, compared to supermarkets which benefit from a zero VAT rate on all food.

As a result, supermarkets are able to use that saving to sell alcohol at a discounted price.

Wetherspoon founder and chairman Tim Martin said: “Pubs suffer a huger disadvantage, paying about 16 pence in business rates per pint versus about two pence for supermarkets.

“In addition, there is a huge VAT inequality and unfairness.

“A reduction in the level of VAT, on a long-term basis, will create a level playing field and generate growth and jobs in the important leisure and hospitality sector and help the high street, of which pubs are an integral part.

“Customers coming to our pubs on Thursday September 19 will find the price of their food and drink is lower than normal.

“We are keen to highlight the amount customers could save if VAT in pubs was lowered permanently.

“We’re aiming to make it the busiest day of the entire year in our pubs.”

UK Hospitality’s chief executive, Kate Nicholls, said: “Tax Equality Day is a great way to highlight just how hospitality businesses are disproportionately hit by VAT.

“Pubs are paying around one third of their turnover in tax, which seriously restricts their ability to invest in their venues and staff, and increases prices for customers.

“A cut in the rate of VAT for the hospitality sector could help to address this unfairness and allow pubs and bars to invest in their businesses and staff members, and provide even greater choice for customers.”