Breaking: Inflation Signals 5 Year Rates Hike of £25 BILLION

Today’s double digit headline rate of inflation will see non-domestic premises in England such as pubs, restaurants, shops factories and offices as well as public sector buildings facing a £25 billion business rates tax hike over the next 5 years.

The distribution of the business rates tax is set through revaluations which periodically reassess and update tax liabilities to reflect changes in the commercial rental market.

The next revaluation comes into effect on 1st April 2023in England based upon an estimate of open market rents on 1st April 2021.

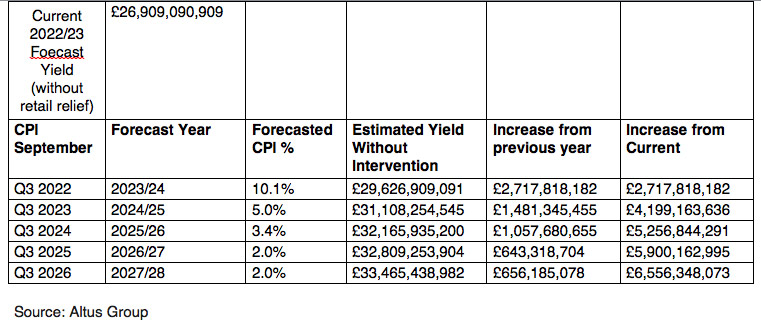

But, whilst that revaluation itself will be revenue neutral, and will raise no extra money for the Treasury, overall business rates revenue for 2023/24 will still be increased by September’s CPI measure of inflation. CPI rose by 10.1% in the 12 months to September 2022.

The real estate adviser Altus Group, Britain’s largest ratings advisory, forecasts that will now signal that overall business rates revenue will rise by £2.72 billion in England from next April without Government intervention.

Robert Hayton, UK President at Altus Group, said

“with more than 1 in 10 UK businesses now reporting a moderate-to-severe risk of insolvency, the time has come to end this ridiculous policy of annually increasing upwards rates revenue by inflation through a renewed focus on growth to drive local taxation revenues instead.”

Whilst the Bank of England expect inflation to start falling next year and have a target of 2% for inflation, they don’t expect inflation to be close to that target for around 2 years.

Even with inflation coming back down to target in around 2 years, Altus Group forecast business rates revenue will swell to £159.18 billion over there next 5 years giving a cumulative total increase of £24.63 billion without Government intervention.

As part of the support package during the pandemic, statutory inflationary increases in business rates were cancelled between 1st April 2020 and 31st March 2023.

Business rates are devolved to Scotland, Wales and Northern Ireland.