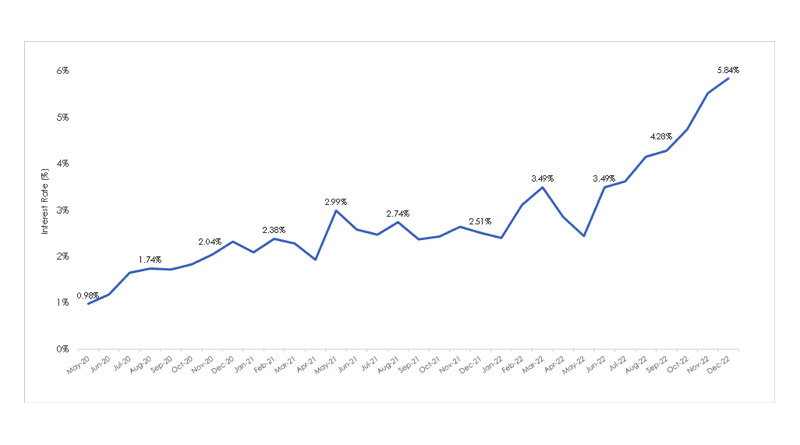

Interest Rates for SME Lending Have Now Increased Almost Sixfold from Pandemic Low

Small businesses face surging interest rates on lending, with the average rate on new bank loans written increasing fivefold from just 0.98% in May 2020 to 5.84%* in December 2022, says UHY Hacker Young, the national accountancy group.

Many SMEs, due to the lack of collateral, will be unable to borrow from banks and will have to pay even higher interest rates from other non-bank funders.

These rates are expected to continue to rise if the Bank of England increases its base rate again. The central bank has pushed up its base rate nine consecutive times in the past year in a bid to control spiralling inflation.

The higher cost of servicing debt means that SMEs will face further financial stress, with many already struggling to cope with rising inflation, labour shortages and surging costs.

Alison Price, Partner at UHY Hacker Young says:

“Rising rates on borrowing can have a major impact on small businesses. Many small businesses are operating on tight margins so even a slight increase in borrowing costs can have a significant impact.”

“These interest rates on bank lending are about the cheapest borrowing that SMEs can get. The interest rates on non-bank lending for SMEs will be far higher.”

Says Alison Price: “For those SMEs who are already struggling with the cost-of-living increases, higher interest rates could mean serious financial trouble.

The situation is unlikely to change for SMEs in the near future, with the Bank of England unlikely to bring rates down until its sees inflation fall substantially.

Future lending to SMEs will also be harder to secure, with the Prudential Regulatory Authority (PRA) warning lenders to scrutinise applicants more thoroughly.