UK Night Club Closures Reveal Changing Gen Z Behavior

As Gen Z spending power grows each year, with the cohort expected to account for *27% of the global workforce by 2025, it’s unsurprising that many food and beverage brands are pivoting towards the evolving needs of this generation.

When nightclub owner Rekom UK announced (15 February 2024) that it had called in administrators with the potential closure of some venues, the company attributed students cutting back on nights out due to the cost-of-living crisis and their changing drinking habits of consuming less alcohol for some of its difficulties.

Students, typically aged between 18 and 22 are prime Gen Z consumers and clearly, behavior changes in this cohort have a potent economic impact not just on this industry but also on the wider grocery landscape as they make a significant contribution to total food and beverage sales, says GlobalData a leading data and analytics company.

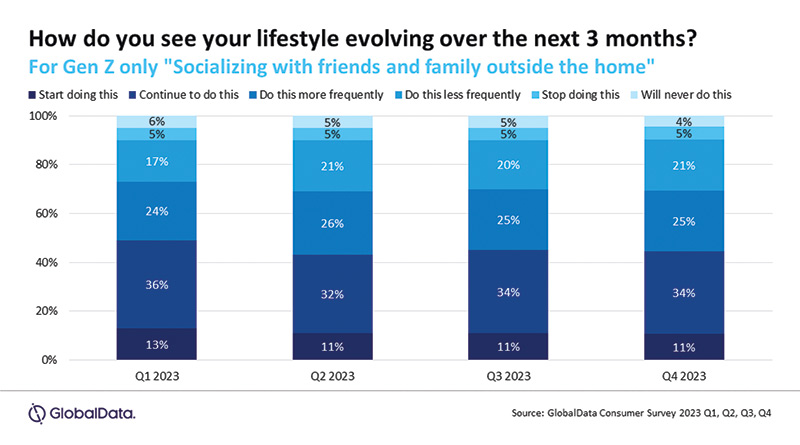

GlobalData’s Q4 2023 consumer survey reveals that a fifth (21%) of Gen Z say that they plan on socialising less frequently with friends and family outside of the home over the next 3 months – a sentiment that has increased over the last year, with only 17% of Gen Zs saying this at the beginning of 2023.

Final Updated Bevs PR chart 070324.PNG

Born between the years 1997 and 2012, Gen Z are currently 12 – 27 years old. Globally, Gen Z represent about a **quarter of the global population, according to GlobalData’s Macroeconomics database, which varies significantly across countries, and according to the World Economic Forum, Gen Zs are expected to account for *27% of the global workforce by 2025.

Nisarga Save, Senior Consultant and Beverages Analyst at GlobalData comments: “As Gen Z’s contribution to total spending exponentially increases over the next decade and they directly benefit from the transfer of wealth from the Silent and Boomers generations, it’s not surprising that many food and beverage brands are pivoting towards this lucrative generation.

“While Gen Z have some shared interests and characteristics with their predecessors, there are also many differences which set them apart from the rest – 21% of Gen Zs report living in a one or two-person household, according to GlobalData’s consumer survey Q4 2023.

“However, the reality of owning a house and other large financial commitments often feels out of reach, and this perceived distance of time encourages them to spend instead of save. They are also spending more time at home and choosing different forms of entertainment to traditional occasions, including night clubs, when they do go out.”

Gen Z mindful consumption

Gen Z consumers are also driven by holistic health and leading a balanced lifestyle, so non-alcoholic and functional beverages are growing in popularity with this cohort. According to GlobalData’s Q4 2023 consumer survey, over a quarter of Gen Zs reported being extremely concerned about their mental well-being and almost 30% of Gen Zs surveyed stated they would “take time to rest and relax” more frequently. Another factor here is that with the advent of social media, these consumers are also conscious of their image and what others think of their actions.

Gen Z product premiumization

Staying in and enjoying their own company or the company of their close connections is still recreation time for Gen Zs, and the savings made by not going out mean they can enjoy more premium products and experiences at home. Products such as RTD beverages, cocktail kits, and luxury meal kits are gaining traction with Gen Zs, while brands are using messaging around the staying in occasion such as “self-care”, “DIY” and “me-time” to position their products.

Save adds: “Gen Zs place higher importance on close and intimate gatherings, which are more personal rather than going out in larger groups. They also desire quality social connections. This means they are more likely to be attracted to brands who offer them ways to enjoy these occasions with innovative flavors, pack sizes fit for at-home consumption, brands offering “insperiences”, and genuine messaging around ‘me time’ and human connections are some of the ways food and beverage companies can appeal to and remain relevant to this generation.”

* Source: The World Economic Forum – “27% of the global workforce in OECD countries by 2025.”

** Source: GlobalData’s Macroeconomics database estimates a Gen Z global population of 1.956 billion. The United Nations estimates the global human population reached 8.0 billion in mid-November 2022.