Cocktail Culture Can Draw Benefits, But Faces Challenges from Gen Z, says GlobalData

The ongoing rise in popularity of cocktails, in traditional hand-mixed as well as ready-to-drink forms, is benefitting from the emergence of Generation Z into the alcohol market. However, cocktail culture risks stagnation if overly fixated on nostalgic themes. Gen Z’s inclination towards quality over quantity, demanding innovation and relevance in their drinking experiences, is shaping the evolving landscape of cocktail consumption, says GlobalData, a leading data and analytics company, in its new report, Industry Insights: Cocktail Culture.

Richard Parker, Principal Consumer Analyst at GlobalData, comments: “Cocktail culture is a historic trend that has undergone several movements over its more than 200 years history. In 2024, it has been influenced by relatively recent developments – the craft alcohol craze, home-based indulgence and entertaining during the COVID-19 pandemic, increased RTD product diversity and sophistication, and the emergence of a more experiential, quality not quantity-focused Gen Z.

“The nature of Gen Z, as the heir to Millennials’ role as the defining consumer generation in the 2020s-2030s, is key in guiding the demand space evolution for alcoholic beverages.”

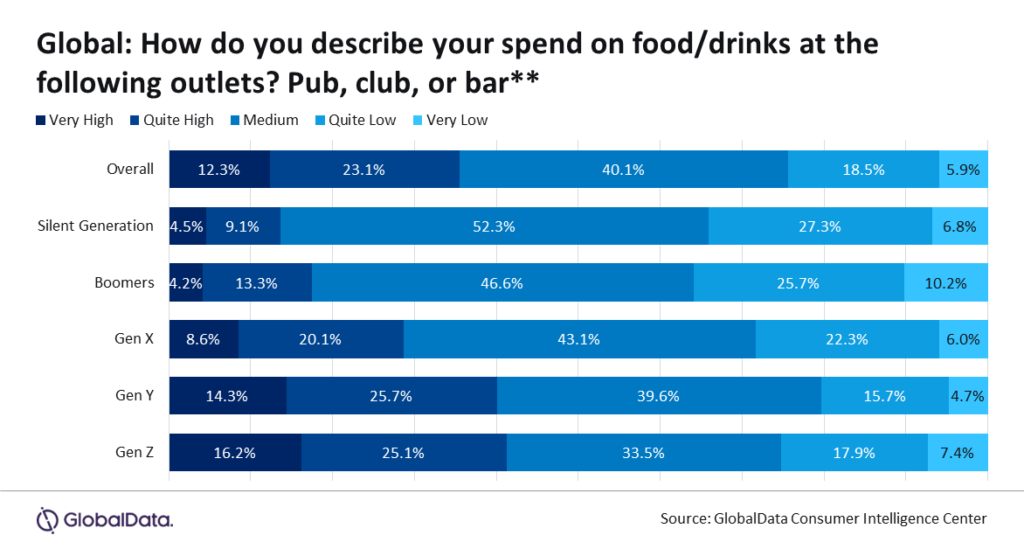

A generational effect is seen in survey findings by GlobalData in how consumers described their spending on pubs, clubs, or bars*. Gen Z is well above average by generation in terms of reporting very high spend on-trade. This is despite the widely accepted view that Zoomers are more ambivalent to alcohol than their predecessors, with different values and goals. The data reinforces the idea of Zoomers as a key generation for “less but better” consumption.

Parker notes: “Tradition has been described as an anchor weighing down innovation in the cocktail marketplace. The old favorites of the cocktail market remain relevant to a large degree, but they are familiar and not exciting to younger generations looking for relevance to their preferences and need for experiential challenges. Cocktail culture has a reactionary element to it, recycling trends from the past, which might appeal to retro connoisseurs and older consumers, but threatens the ability to keep the segment vital for newer consumers.

Overall, this becomes a discussion of “democratizing” the cocktail experience – making it more relevant to a wider range of consumers and less exclusionary based on perceptions of exclusivity.

Parker concludes: “The risk is that a maturing Gen Z, with other interests and motivations, see mainstream cocktails and related bar concepts as anachronistic, especially those with a strong heritage basis.”

*GlobalData 2023 Q4 Consumer Survey – Global, published in Q4 2023, sample size – 21,291