Freeze Alcohol Duty Chancellor Urged

Wine and spirit businesses are calling on the Chancellor to freeze to alcohol duty, until the end of the Parliament, when he delivers his Autumn Statement on 22 November.

The Wine and Spirit Trade Association argues that a duty freeze is the only option to prevent further inflation-stoking price rises for cash strapped consumers.

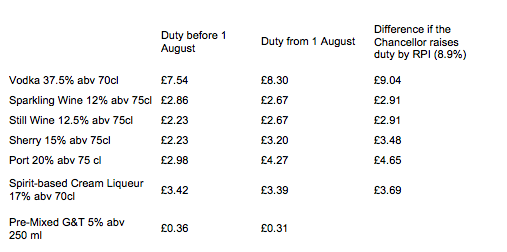

If Jeremy Hunt chooses to increase duty by RPI, currently 8.9%, when added to the increases on 1 August this would result in cumulative excise duty increases of 68p on a bottle of wine, £1.50 on a bottle of spirits and £1.67 on a bottle of port.

The budget busting duty hike would mean the Chancellor has announced a 30% increase in wine duty and 20% increase in spirit duty, in the space of six months.

According to ONS data for average prices on items in your shopping basket in September 2023:

• The average price of a bottle of red wine is £7.72 – (ONS price increase data for last year is unavailable)

• The average price of a bottle of vodka is £16.80 – up 14% on last year.

• The average price of a bottle of gin is £17.01 – up 10% on last year.

• The average price of a bottle of fortified wine is £11.53 – up 17% on last year.

These average bottle prices do not however include the full impact of the August duty rises – as not all the stock sold in August and September would have included the new duty rates.

If consumers were expected to pay for a second duty rise this year the average price of a bottle of red wine is expected to go over £8 for the first time. And the average price of a bottle of gin or vodka is expected to exceed £18 for the first time.

Miles Beale, Chief Executive of the Wine and Spirit Trade Association, said:

“We are calling for a freeze for the remainder of this Parliament to prevent budget busting price rises.”

“Consumers are still in the grip of a cost of living-of-living crisis and cannot afford to keep stretching their budgets just to be able to enjoy some of life’s little luxuries. Wine and spirit businesses need a breathing space to stay afloat in the current economic climate, which continues to combine lethargic growth with persistently high inflation.”

“In August the Treasury introduced the largest alcohol tax hike for almost 50 years adding over 10% duty increase for spirits and over 20% increase for 4 out of 5 wines of all wine sold in the UK.”

“A further rise would make a mockery of the Government’s priority is to cut inflation as further prices rises will lead to reduced sales and less revenue to the Exchequer.”

The WSTA has written to the Chancellor to highlight the unfair approach to taxing alcohol, which has seen wine and spirits treated more harshly by successive Conservatives Chancellors since 2010”

• Beer duty has gone up 21%

• Spirits duty has gone up 32%

• Still wine duty has gone up 58%

• And duty on a bottle of 20%abv Port by 90%

Wine businesses have repeatedly raised their concerns that the new tax rates unfairly target wine drinkers and will make the UK market a less attractive place to sell wine.

History has shown that freezing duty tends to increase Treasury revenues, not the opposite.

The new alcohol duty regime which came in on August 1 means all alcohol is taxed by strength for the first time. This comes on top of dramatically increased supply chain costs.

The cost of wine and spirits has continued to rise in recent years due to the enormous increase in the recycling fees that glass manufacturers must pay.