High Street Firms See Tax Slashed by £5,500 from Today

Publicans, shopkeepers, restauranteurs, small hoteliers, and other high street firms the length and breadth of England will see tax cuts of more than 50% from today as new property values, the first revaluation for 6 years, comes into effect.

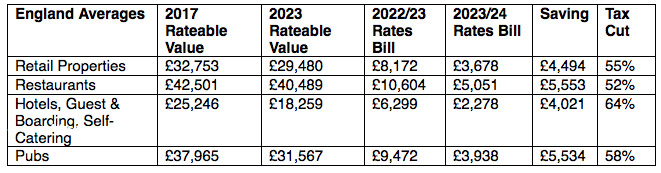

According to the commercial real estate intelligence firm Altus Group, the average retail shop will save £4,494 on its business rates tax, pubs £5,534, restaurants £5,553 and accommodation businesses £4,021.

Source: Altus Group

New commercial property values, used to calculate the business rates tax, come into effect from today for all non-domestic properties reflecting changes in the property market between 1st April 2015 and 1st April 2021.

The retail sector has seen their rateable values fall by 10%, pubs by 17%, restaurants by 5% and hotels, serviced apartments, and guest & boarding houses by 28% overall according to Altus’s annual review.

New rateable values will be used to determine the basis of business rates bills from today for 3 financial years.

As part of a £13.6 billion support package announced last Autumn, the Government have also frozen the tax rates from 1st April protecting firms from rising inflation whilst increasing the retail, hospitality, and leisure discount from 50% to 75% for 2023/24 up to a cash cap of £110,000 per business.

Even the large retailers subject to the cap on the discount will see big tax reductions under the revaluation with the Government ensuring ratepayers benefit from decreases in values, in full, straight away.

Iconic London department store Harrods has seen its valuation plummet 45% from £32.73 million to £18 million saving the retailer £7.84 million in business rates from today for 2023/24. Harrods will see its tax bill fall from £17.41 million to £9.57 million according to Altus Group.

Alex Probyn, Global President of Property Tax at Altus Group, said “these tax changes will bring much needed respite from the current high cost-of-doing business for high street firms” but warned “the freeze in tax rates and the bigger retail discount are just a 1-year commitment.”

Revaluations are also coming into effect today in Wales, Scotland, and Northern Ireland where business rates are devolved.