UK Hotels Expected To Rebound Strongly Post-COVID-19

– Q4 envisaged to see a surge in investment activity once travel restrictions are eased –

– Full market recovery in London possible by the end of Q4 2021-

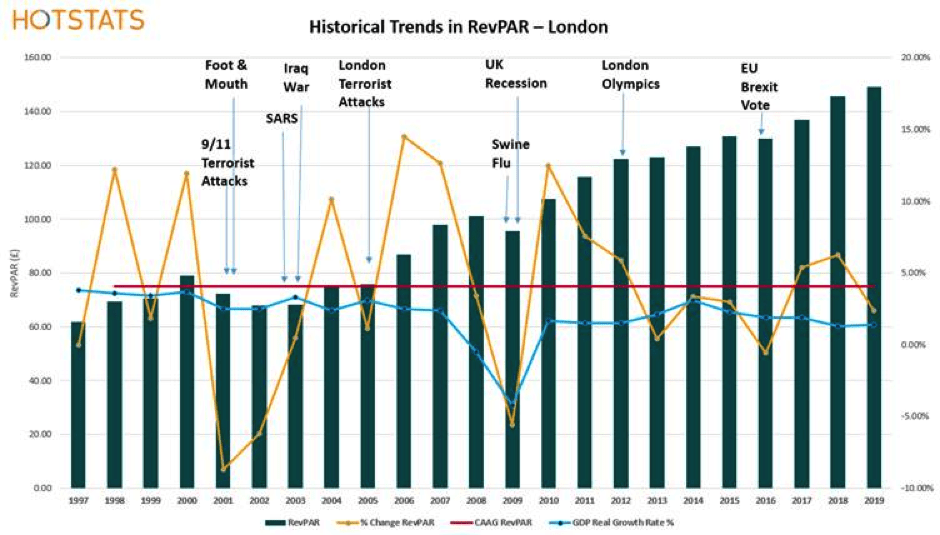

– Modelling based on SARS and global financial crisis provides hope for swift return to positive growth –

The UK hotel market will rebound strongly once the economy revives and travel restrictions are lifted post the COVID-19 pandemic. According to research by leading global property adviser Knight Frank, assuming the UK hotel market reopens by the end of Q2 2020, Q4 is expected to see a surge in investment volumes, whilst London is expected to make a full market recovery in terms of trading performance by the end of Q4 2021.

Knight Frank’s research analyses the speed at which the UK hotel market has recovered following major events in the past, such as the economic downturns in 2001 and 2009, SARS and Brexit. These findings provide some hope for a reasonably swift return to positive growth figures, despite there still being many unknowns ahead.

The strict measures imposed to control the spread of COVID-19, mean that the immediate economic impact is anticipated by many to be more severe than past economic downturns, with hotels likely to be severely affected from the challenges coming from a period of lockdown.

Despite this, Knight Frank forecasts a V-shaped, stepped recovery, with occupancy growth beginning slowly in Q3 followed by substantially stronger growth in Q4 as travel confidence returns. A full rebound in RevPAR[1] is anticipated once international borders properly re-open and long-haul inbound visitors return, enabling growth in ADR[2].

Shaun Roy, Head of Hotels and Specialist Property Investment at Knight Frank, said: “The COVID-19 pandemic is an unprecedented event and is having a severe impact on the UK hotel market, which is disproportionately affected in many ways.

“Whilst the lock down continues, the current focus for the hotel market remains one of survival, with cash conservation and liquidity of immediate concern. Yet as we look beyond this, and at how the UK hotel market has fared following other significant global events, we believe that the UK hotel market will recover and rebound strongly.

“Assuming the UK hotel market reopens by the end of Q2 2020, this will, lead to a potential full recovery in London by the end of Q4 2021, whilst the severity of the economic downturn will determine how quickly regional UK returns to a level of trading enjoyed prior to COVID-19. Together with the ongoing negotiations surrounding Brexit, the pound is expected to remain attractive to investors and support an uplift in investment volumes nationally.”

Knight Frank remains cautiously optimistic about the strength of the recovery of the UK hotel market in 2020, anticipating that a recovery plan will initially be focused on driving domestic leisure demand. This will likely be bolstered by a possible extension to the summer holiday period if schools remain closed until September. With the continued restrictions on international travel anticipated, as individual countries deal with the widespread outbreak of COVID-19, UK residents are likely to opt to travel rather than abroad.

Knight Frank considers that particularly during the early months of recovery, corporate budgets are likely to be squeezed and unemployment will further dictate the disposable income available and therefore the propensity to spend on leisure-based experiences. Once travel restrictions have eased, international visitor arrivals will return over the coming months, whilst investment activity is expected to resume, with a surge of activity anticipated in Q4-2020, owing to a time lag for due diligence.

In the immediate term, hotels are focused on cash conservation and liquidity to ensure their survival, which have been boosted by the range of fiscal measures implemented by the UK government, including the 12-month business rates holiday for the hospitality sector, and the ability to furlough staff for an initial period of up to 3-months.

Once restrictions on social distancing have eased, some hotels may delaying re-opening, choosing instead to reopen once sufficient demand exists and occupancy has increased significantly, to ensure that any operating losses are less than the holding costs of keeping the hotels closed. Some of the larger chains, who have multiple hotels in the same geographic markets, are also likely to phase the opening of their hotels where possible. Hotels which depend to a large extent on the meeting & conference segment, might well stay closed for a prolonged period, before customer confidence is restored and government restrictions allow for large events to be held.