UK Property Taxes Remain Highest

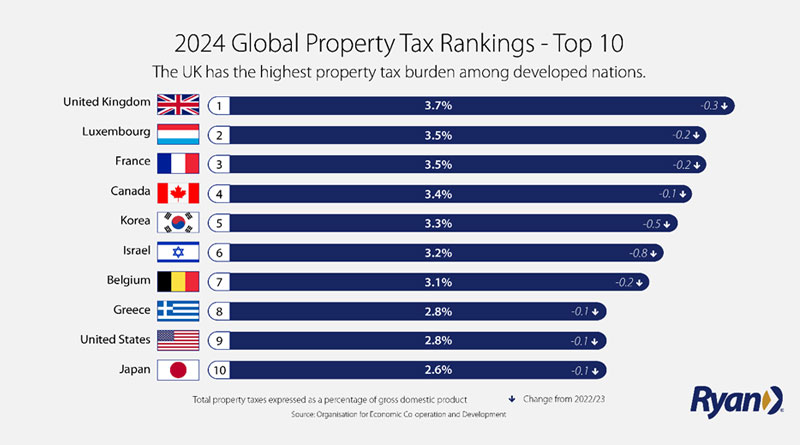

The UK continues to hold the unenviable accolade of having the highest property taxes across the entire developed world, the equivalent of 3.7% of property taxes-to-gross domestic product (GDP) in 2024, albeit down 0.3% on the previous year, according to new global property tax rankings released today by the global tax and software firm Ryan ahead of the Spring Statement.

Isreal, who jointly topped the rankings with the UK in 2023, fell to 6th place in the new rankings with their property taxes-to-gross domestic product (GDP) falling 0.8%.

Ryan added that the UK’s property tax-to- GDP ratio continues to remain much higher than the 1.7% average across the developed world and the 2.7% average for the group of seven (G7), the informal grouping of seven of the world’s advanced economies. Whilst across the economic and political union of the European Union, the comparable average was just 1.4% Ryan found.

In the UK, property taxes include all tax receipts from council tax (domestic), business rates (non-domestic), SDLT (stamp duty land tax) and LBTT (land and building transaction tax) in Scotland.

“The UK is characterised across the developed world as having high levels of revenue from taxes on property” said Alex Probyn, Practice Leader of EAP Property Tax at Ryan.

Revenue from the business rates tax across the whole of the UK is expected to raise £32.1 billion, up £2.8 billion for the financial year ending on 31st March 2025, growing by 9.6 per cent on the previous year. The 6.7% rise in the standard rate of tax a key driver for that increase.

Probyn added “Our clients already tell us that the level of the business rates tax act as a disincentive to invest and the current effective tax rate of 54.6%, which will rise to 55.5% on 1st April 2025, for commercial property does nothing to dispel that.”

Business rates are devolved to Scotland, Wales and Northern Ireland.