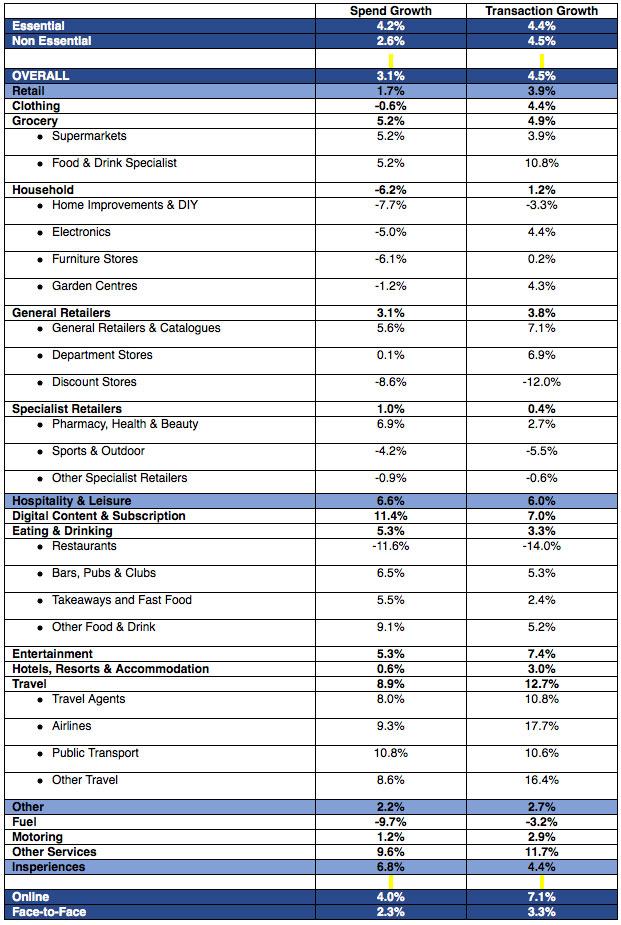

Consumer card spending grew 3.1 per cent year-on-year in January – less than the latest CPIH* inflation rate of 4.2 per cent, yet higher than December’s growth of 2.3 per cent.

Retail, hospitality and leisure spending slowed as Brits stayed at home to shelter from the cold weather and save money after a busy festive period. However, pointing to improving optimism, consumers’ confidence in both their household finances and ability to spend within their means reached its highest point in over two years.

Spending on essential items increased 4.2 per cent – noticeably higher than in December (1.8 per cent). This was largely driven by a recovery in fuel spending, in light of the new energy price cap coming into effect 1 January, which saw a smaller decline (-9.7 per cent) compared to December (-12.5 per cent). Growth in supermarket spending increased to 5.2 per cent – up from 2.8 per cent in December – on par with the growth seen in October (5.2 per cent) and November last year (5.0 per cent), as UK consumers returned to their regular routines after the Christmas break.

Supermarket savings are also expected to impact hospitality Valentine’s Day celebrations, Valentine’s Day is typically one of the busiest dates in the calendar for florists, second only to Mother’s Day, with a supermarket meal-deal on the menu for just over two in five of those making a home-cooked meal.

Other cost-saving strategies include spending the evening at home instead of going out (21 per cent), setting a spending limit for gifts (18 per cent), and forgoing presents altogether (16 per cent).

Even with these cutbacks, Brits expect to spend slightly more this Valentine’s Day compared to last year (up £6.40), likely due to rising prices. In total, the average love-bird expects to spend £80.30 – with men expecting to spend over 50 per cent more than women (£96.70 compared to £60.70 for women).

Home comforts over big nights out

Spending on non-essential items increased 2.6 per cent in January – consistent with the growth seen in December and November last year, at 2.5 per cent and 2.7 per cent respectively. This comes as over two fifths (43 per cent) of consumers say they are planning to cut down on discretionary spending due to rising household bills, with many tightening their belts after the festive season.

Spending on takeaways and fast food was up 5.5 per cent year-on-year in January, with those that spent money on food to-go forking out £55 on average each. Meanwhile, digital content and subscriptions had yet another bumper month, up 11.4 per cent, following December’s 11.6 per cent boost, as Brits embraced nights in, enjoying new releases such as ‘Mean Girls’, ‘The Traitors’ and ‘Fool Me Once’.

This shift in behaviour, as well as the popularity of Dry January, meant that bars, pubs and clubs saw a smaller uplift (6.5 per cent) than in December (7.9 per cent), while restaurants faced a steeper month-on-month decline (-11.6 vs -8.8 per cent). Of those planning to limit discretionary spending throughout the winter, three in five (59 per cent) said they will be cutting back on eating out at restaurants.

Optimism prevails

While rising household bills remain a concern for the majority (88 per cent), the nation is feeling more optimistic overall, with consumers’ confidence in both their household finances and ability to live within their means reaching its highest point since November 2021 (70 per cent and 74 per cent respectively).

Karen Johnson, Head of Retail at Barclays, said: “After a December filled with festive indulgence, Brits took on a more frugal approach in January, choosing to stay at home more often to save money and shelter from the winter weather.

“This meant that online retail performed strongly, as shoppers browsed the sales from the comfort of their sofas, while demand for digital content and takeaways remained robust, boosted by the release of popular new film and TV releases such as ‘The Traitors’ and ‘Fool Me Once’.

“While this shift in behaviour resulted in subdued growth for hospitality and leisure, it’s encouraging that confidence is improving, with consumers remaining resilient and finding savvy ways to manage their finances.”

Jack Meaning, Chief UK Economist at Barclays, said: “Increasing consumer confidence is a positive message for the UK outlook in 2024, as we see inflation continue to fall, real incomes rising and growing signs that interest rate cuts are coming. Spending looks to be on an upward trajectory, set to increase more than inflation in the coming months, which will be an important milestone for consumers and businesses who were squeezed throughout 2023.”