Majority of UK Hotel Arrivals Came from Overseas in 2023, Signalling Return of International Travel Despite Higher Prices: SiteMinder

A new report by SiteMinder, the name behind the only software platform that unlocks the full revenue potential of hotels, shows that the UK hotel industry is entering a new era of travel, after rises in international hotel arrivals in 2023 triggered a wave of changes in travel behaviour.

The report, SiteMinder’s Hotel Booking Trends, based on more than 115 million hotel bookings, reveals that the majority of UK hotel arrivals came from overseas throughout 2023, with check-ins from international guests growing by 17% to 52% of stays year-on-year. This aligns with the global trend, which saw international check-ins rise by an average of 33% from the year prior. The top travel source markets for British hotels were the US, Germany, France, Australia, and Italy.

Higher prices, longer average lead times and ongoing short stays

In spite of increased prices—the average daily rate jumped 8% from the prior year to £193—the rise in international arrivals saw travellers book their stays sooner, with the average lead time growing 7% versus 2022, to 41 days – over four days longer than in 2019.

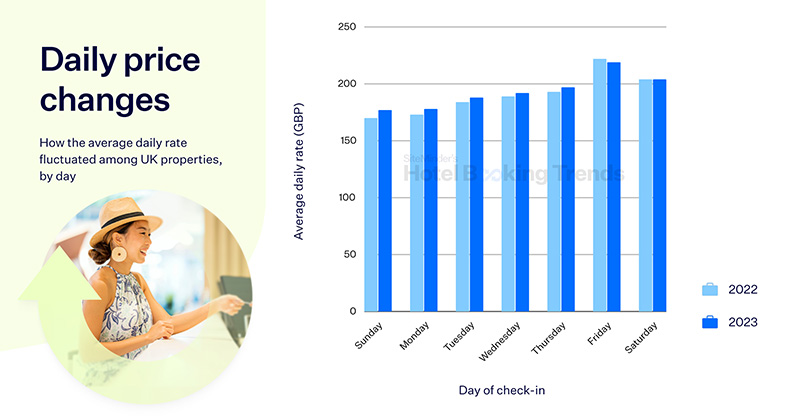

ADR unsurprisingly peaked during the summer holidays, averaging £213 in June 2023, while Friday stays were the most lucrative, with an ADR of £219, followed by those on Saturday (£204) and Thursday (£197). January was again the cheapest month for guests, with an ADR of £155.

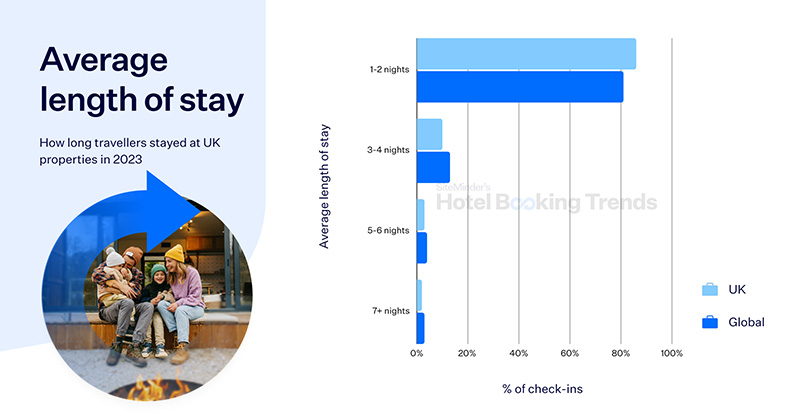

Short stays, due in part to London being a haven for business travel, were again a driver of the vast majority of arrivals, with UK hotels hosting among the shortest stays in the world. Eighty-six percent were for 1-2 nights, compared to the global average of 81%, while 96% were for 1-4 nights.

A changing market is demanding a dynamic approach from accommodation providers

SiteMinder’s vice president of ecosystem and strategic partnerships, James Bishop, says the findings are encouraging for UK hoteliers, but they shouldn’t expect a return to the old normal at a time of industry-wide change.

“SiteMinder’s data and research shows that while international travel is returning strongly, and traveller demographics are normalising, today’s guests are a strong departure from those that hoteliers once knew. Increasingly, travellers have a nuanced approach to spending. While they are experience-driven and prepared to purchase extras beyond the cost of their room, they are more often turning to packages and promotions that allow them to continue travelling the way they know and love,” says Bishop.

“This increasingly sophisticated traveller behaviour underscores the need for hoteliers to be dynamic in the way they do business. We already see signs of this—for example, the UK has some of the world’s highest day-to-day variation in room rates, indicating that hoteliers are already adopting nimbler practices to keep pace with changing customer preferences. As international and business-related travel ramps further, it’s vital for the hotel industry to continue evolving, to ensure it is monetising revenue opportunities at every customer touchpoint,” concludes Bishop.

The “Asian giants” return –– a turning point for the global sector

The rise in international travel globally was spurred by the strong rebound of outbound Asian travel in 2023, with two of the region’s most popular channels, China’s Trip.com and Asia Pacific’s Agoda, rising the fastest among SiteMinder’s Top 12 hotel booking sources, based on the total gross revenue they generated via SiteMinder’s platform.

In the UK, Trip.com rose from eleventh to seventh place, while Agoda climbed one spot to fifth:

SiteMinder’s Chief Growth Officer, Trent Innes, says: “The global travel industry has long awaited the return of Chinese travellers and it is clear from our data that they are beginning to come back, alongside those from other source markets throughout Asia, such as India, Japan and South Korea. Hotels would do well to prepare for a change in the mix of travellers arriving at their doorstep, by revising their marketing strategies to reach the world’s fastest-growing travel sources and gaining intelligence on these potential customers to maximise their revenues.”

The annual SiteMinder’s Hotel Booking Trends report is the most authoritative analysis of the hotel bookings made by the world’s travellers. The data is based on the booking data of SiteMinder’s more than 40,000 hotel customers, which in 2023 used SiteMinder’s platform to secure more than 115 million bookings valued at more than US$45 billion in revenue. It is available in full here.

UK hoteliers are invited to a webinar on February 29, where the report’s findings will be discussed in-depth. Hoteliers can register here.