Front-of-House Hospitality Workers set to Benefit Most from National Living Wage

The latest figures from hospitality software provider Fourth reveal that the new National Living Wage (NLW) rates will mostly benefit front-of-house workers, who will see their hourly wage increased to be more in line with that of their counterparts in back-of-house roles. For businesses, however, this means a further squeeze on margins to accommodate the new pay rates.

Back-of-house workers, typically those employed in the kitchen, are already earning above the new NLW of £9.50 per hour, that came into force on 1 April; while front-of-house workers, typically waiting and bar roles, are currently paid significantly below the new NLW rates.

Fourth’s data – which is aggregated from the analysis of more than 700 companies across the hospitality sector – reveals that wages for back-of-house workers have increased significantly over the last 12 months, due to the ongoing recruitment crisis as businesses have looked to fill skilled roles, such as that of chefs, by offering higher wages. Unlike front-of-house colleagues, back-of-house workers do not have the opportunity to earn customer tips, although they often receive ‘a cut’ of them. Those working in pub kitchens have seen the biggest rise, with rates of pay up 6.8% over the past 12 months, while wages for back-of-house restaurant workers have increased by 3.7%.

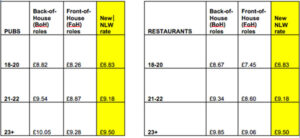

The figures show that, overall, pub and restaurant wages, broken down by age range, were tracking as follows up until the end of March 2022: Furthermore, Fourth’s data reveals that:

Furthermore, Fourth’s data reveals that:

- On average, over the last 12 months the rate of pay for pub workers has increased by 4.9% and for restaurant workers by 2.9%

- Wages for pub workers aged 23+ have increased by 6.7% over the last 12 months; while wages for restaurant workers aged 23+ are up 4.3%

- Overall hospitality staff headcount is up by 27% on March 2021, but down by 12% on March 2020 and down by 15% on March 2019

- British workers make up 55% of the workforce, EU workers make up 28% and non-EU workers make up 17%

- The number of hours worked in March 2022 was 12% higher than the previous month (February 2022), but still 12% down on pre-pandemic levels recorded in February 2020

The make-up of the workforce by nationality

Fourth’s data indicates that British workers currently account for 55% of the hospitality workforce, compared to 48% at the end of March 2021 – a seven percentage point increase. EU workers make up 28% of the workforce, compared to 40% in March 2021, and workers from non-EU countries currently make up 17%, compared to 13% in March 2021. This has been a continuous trend since the outbreak of the pandemic in March 2020, resulting in an increase in British and non-EU workers in the sector and a decrease in workers from EU countries.

When broken down by sector, the restaurant workforce has seen the biggest shift, with British workers currently making up 52% compared to 41% in March 2021. The proportion of EU workers currently makes up 31%, a significant decrease from 47% last year. Interestingly, the quick-service restaurant sector has seen a decrease in EU workers but an increase in non-EU workers from the rest of the world, rather than British nationals; the proportion of non-EU workers has increased from 7% in March 2021 to 20% now, while the proportion of EU workers has fallen from 47% to 36%.

Hospitality hours worked and staff headcount

The number of hours worked in March 2022 was 12% higher than the month prior (February 2022), but still 12% down on pre-pandemic levels recorded in February 2020.

When breaking down the number of hours worked in March 2022 versus February 2020 by sector, it is evident that pubs have seen the biggest recovery, with hours worked just 4% down on pre-pandemic levels in February 2020. This is followed by QSRs at 8% down; hotels at 11% down; and, finally, restaurants at 16% down.

When looking at staff headcount, there has been a 27% increase in the number of workers currently in the industry compared to March 2021. Encouragingly, this is just 12% down on March 2020 – still a decrease, but the least impactful since the outbreak of the pandemic – and 15% down on March 2019.

Sebastien Sepierre, Managing Director – EMEA, Fourth, said: “As the hospitality industry continues on the road to recovery, it is evident that major obstacles still stand in the way. The Government’s decision to go ahead with the VAT increase from 12.5% to 20% has been met with disdain and the increase in the NLW rate, while good for workers, is set to put even more pressure on already squeezed margins. The sector still requires as much support as it can get, in the face of the cost-of-living crisis for consumers and soaring operating costs for businesses – the VAT hike, in particular, couldn’t come at a worse time and will force businesses to regrettably increase menu prices.

“Given these challenges, it’s more important than ever that operators continue to plan ahead to protect their bottom line and maximise efficiencies when it comes to labour and inventory management. Technology and digital solutions play a key role in ensuring businesses can hire, train, engage and retain workers, providing smart solutions to work within their means and manage consumer demand in these testing times.”