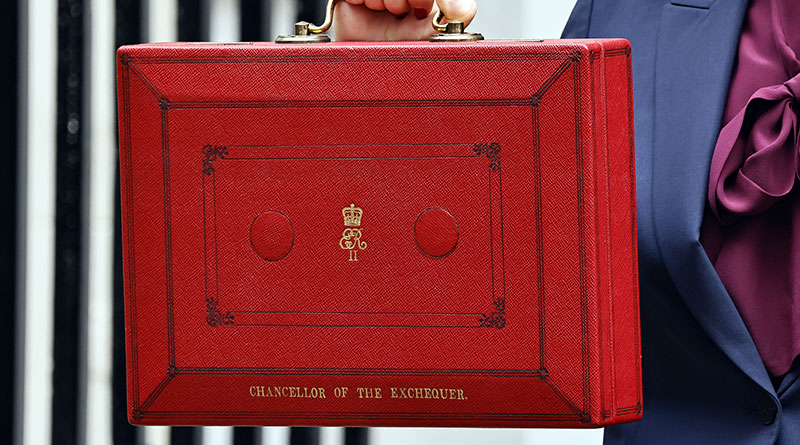

Industry Reacts with Dismay to Chancellors Budget

Industry leaders have expressed deep disappointment with Chancellor Rachel Reeves’ Autumn Budget delivered on Wednesday 26th November warning that the package of measures represents another devastating blow to an already beleaguered hospitality and licensed on-trade sector struggling through its toughest trading conditions in recent memory.

While the chancellor confirmed permanently lower business rates multipliers for over 750,000 retail, hospitality and leisure properties from April 2026, the failure to extend the current 40% business rates relief at existing levels, combined with rising operational costs and frozen income tax thresholds squeezing consumer spending power, has left operators warning of further closures and job losses ahead.

Kate Nicholls, Chair of UKHospitality, said:

Kate Nicholls, Chair of UKHospitality, said:

“Bricks and mortar hospitality businesses are being taxed out, and they have been penalised by the broken business rates system for far too long.

“Today the Chancellor recognised the importance of hospitality and provided a permanently lower multiplier for hospitality businesses – reforms secured by UKHospitality.

“However, the 5p discount is only a quarter of the maximum 20p discount the Government proposed last year.

“This is particularly frustrating given changes to business rates valuations will mean that many hospitality businesses’ tax bills will still significantly rise, alongside increases to the minimum wage adding extra cost. Business tax rates for hospitality must continue to fall for the rest of this parliament.

“The Government has heeded our calls for significant transitional relief for businesses, which will mitigate the worst impacts of the revaluation.

“Hospitality remains under significant cost pressures, with the highest tax burden in the economy. We will continue to campaign for additional support for the sector, including further business rates discounts.”

Dawn Hopkins, Vice Chair of the Campaign for Pubs said:

Dawn Hopkins, Vice Chair of the Campaign for Pubs said:

“Week after week, eight more pubs vanish for good – taking with them people’s livelihoods, community spaces and vital local jobs – yet the Chancellor has chosen to look the other way.

“Publicans and pub lovers have been crystal clear about what support is needed, but we have been ignored. Instead there are no measures to address the disastrous hike in costs in last year’s budget and an additional hike in costs though wage increases. Only the already announced reform of business rates, which will provide only a little help for some pubs in England but nothing for all other pubs. As a licensee, I am deeply disappointed, sad and frankly scared for the future. It is disgraceful that this Government is prepared to watch the collapse of our pub industry rather than act to save it”.

Greg Mulholland, Campaign Director for the Campaign for Pubs said:

Greg Mulholland, Campaign Director for the Campaign for Pubs said:

“This is a deeply disappointing budget that does nothing to address the crisis facing the UK’s world-famous pubs. There’s some limited support for some pubs in England through business rates, but no support whatsoever for pubs in Scotland, Wales & Northern Ireland.

“Despite around 90,000 lost jobs in hospitality since last year’s disastrous budget, the Chancellor has done nothing to address those damaging cost hikes and indeed has imposed further costs on pubs and publicans who have to pay increased staff wages, at a time when many publicans are already earning less than their staff. Altogether this budget will mean yet more job cuts in pubs and more publicans unable to make a living”.

Ash Corbett-Collins, CAMRA Chairman said:

Ash Corbett-Collins, CAMRA Chairman said:

“This is a dark day for UK drinkers, pubs and breweries. Instead of offering a bold package to save and support the UK’s pubs, the Chancellor has chosen not to help with VAT, energy bills or Employer National Insurance contributions. Pubs and breweries can contribute to economic growth but only with proper support from the Government on sky-high costs which are making it impossible for many pubs to survive and thrive.”

“The decision to introduce permanently lower business rates for hospitality businesses in England from next May is a positive step and is long overdue. The Treasury has stated that all retail, leisure and hospitality businesses will pay lower rates bills than they do at the moment, even with the 40% discount on business rates bills ending next year. This is encouraging, but pubs will want to know just how much they will be paying to be able to plan and to know how much this decision will help them at a time when other costs continue to rise.”

“We are bitterly disappointed that alcohol duty has been hiked today. Instead of delivering a substantial cut in tax breweries pay on their beer going to be sold in pubs, the Chancellor has made the damaging choice to hike alcohol duties, including on draught beer and cider. As well as a cut in VAT and help with energy costs and Employer National Insurance contributions, Rachel Reeves should have taken action to recognise the benefits of drinking in community locals by slashing tax specifically on pints in pubs by up to 50% to help them compete with cheap supermarket alcohol. This extra hike in taxes on drinking in the pub can only risk more pubs and breweries being lost to the communities they serve.”

“Pubgoers and pub licensees will be shocked that the only mention of supporting pubs in the Chancellor’s statement was re-announcing some tinkering around the edges of the licensing system in England and Wales. This just doesn’t cut it. Hundreds of pubs have closed this year and thousands more are at risk because of this Budget where no support has been given on VAT, energy bills, alcohol duty or Employer National Insurance contributions.”

Michael Kill, CEO, Night Time Industries Association: “This Budget is a hammer blow to an already fragile night-time economy. Its impact will be felt across every high street and town centre in the UK. With inflation now higher than its been for some months and the cost of living becoming increasingly unsustainable, disposable income has all but disappeared, swallowed up by rising everyday costs.

Michael Kill, CEO, Night Time Industries Association: “This Budget is a hammer blow to an already fragile night-time economy. Its impact will be felt across every high street and town centre in the UK. With inflation now higher than its been for some months and the cost of living becoming increasingly unsustainable, disposable income has all but disappeared, swallowed up by rising everyday costs.

“We are deeply concerned by the scale of direct and indirect tax increases set to hit our sector over the coming months. Many venues are already operating on the edge, and we will inevitably see businesses handing back their keys by January, when VAT, quarterly rent payments, and other financial obligations collide. The pressure on both operators and consumers is now completely unsustainable.

“A 4.1% increase in the minimum wage to £12.71 may sound positive on the surface, but when coupled with an 8.5% rise for 18–20 year-olds, it presents a serious challenge for a sector that employs a large proportion of young people. Without meaningful support for businesses, this risks devastating consequences for staffing, long-term sustainability, and job opportunities in the very communities the Government claims to champion.

“This is not about political point-scoring, or blame. These are Government decisions, and they must take responsibility for the consequences. People will respond, at the ballot box and in their communities. As we head towards May next year, one thing is clear: the honeymoon period is over, and the night-time economy will not forget.

“The Chancellor has clearly not read the room. In fact, for many in our sector, it feels like the Government left the room a long time ago.”

Andy Slee, SIBA Chief Executive Society of Independent Brewers and Associates:

Andy Slee, SIBA Chief Executive Society of Independent Brewers and Associates:

“Today’s Budget is a bitter blow for beer drinkers, community pubs, and small breweries. Instead of supporting a sector already under immense pressure, the Chancellor has chosen to increase beer duty on top of a raft of other tax rises. She had a real opportunity to build on last year’s progress by extending Draught Relief — a move that would have ensured beer sold in pubs carried a lower rate of duty — but she chose not to act.

“It was however positive to see the Chancellor narrow the disparity in tax paid by online gambling businesses compared to high-street and hospitality businesses, something which SIBA has sought to see Government address.

“Lastly, whilst the Business Rates reform is welcome, offering permanent relief for pubs and hospitality – and the commitment to modernising licensing is a step forward – these measures fall far short of addressing the escalating costs facing pubs and breweries up and down the country.

“In the past year alone, we’ve lost more than 100 small breweries, and many more are now on the brink. Without meaningful support, we risk losing vital community institutions and the independent producers that keep Britain’s beer culture alive.”

Simon Dodd, CEO of Young’s, said:

Simon Dodd, CEO of Young’s, said:

“Our teams sit right at the heart of every Young’s pub. We are proud to back fair pay, but these wage increases land another £1.4bn blow to our sector, adding to the significant pressure we are already grappling with.

“The Government has not gone far enough to tackle the other unfair costs weighing down pubs – and has added more pressure with the rise in alcohol duty, so it will continue to be challenging for pubs to keep rewarding our people and keep doors open.

“ As a result, it will just get harder for young people to find jobs in an industry that’s always been a major employer for them.”

Adam Flint, Chair of Bristol Hoteliers Association (BHA), said:

Adam Flint, Chair of Bristol Hoteliers Association (BHA), said:

“The final quarter of 2025 for the hotels and city was very buoyant compared to other quarters this year, which was very encouraging.

“But the Chancellor’s budget has somewhat dampened the enthusiasm we were feeling towards the end of the year.

“Our members have long supported the calls from trade body UKHospitality for lower business rates, a reduction on VAT for hospitality businesses and changes to National Insurance Contributions for employers.

“The Chancellor did reveal that the government would permanently lower business tax rates for more than 750,000 retail, hospitality and leisure properties, to the lowest rate since 1991, which may offer some relief to some venues, but it’s not nearly enough.

“If anything, times will become even more challenging for us, thanks to the higher-than-expected increase in the wage rate for 18-to 20-year-olds, adding to the burden of soaring food prices, increased insurance premiums, the recent increase in national insurance contributions and continued pressures of rising energy costs.

“As for the tourist tax, we know that many European cities already have this, but in most of these places, hospitality is taxed at 5% VAT rather than the 20% here.

“Add to that the Chancellors decision to freeze personal tax thresholds for a further three years, which means disposable incomes will be reduced in real terms, further limiting people’s ability to spend on hospitality and leisure, and they are certainly likely to be deterred from going to places charging the Tourist Tax.

“We would also be interested to know more details, such as who will run the tourist tax and where, exactly, the money it generates will be used.

“The concern is the monies will be used to fill underinvested areas of local council, rather than supporting new initiatives that benefit the industry.

“But overall, given the huge contribution hospitality has made to the nation’s economy, this budget has again given us cold comfort as we head into the winter.”

Giles Fuchs, Owner of Burgh Island Hotel, comments:

Giles Fuchs, Owner of Burgh Island Hotel, comments:

“Permanently lower business rates for hospitality offer necessary relief, but this Budget exposes a fundamental gap between what’s being given and what’s simultaneously being taken away. The decision provides stability at a time when operators face mounting cost pressures, yet the wider package underlines how tight the operating environment will remain.

“The National Living Wage increase to £12.71 worth £1.4 billion in additional costs to hospitality alone combined with frozen income tax thresholds will increase employer costs while reducing disposable income for potential visitors. Add powers for English mayors to levy visitor taxes and higher taxes on property, savings and dividend income, and operators are left absorbing structural financial pressures without parallel investment in growth.

“The sector now needs a long-term strategy that goes beyond rate reductions. Support for workforce recruitment and retention, access to training, help to accelerate the shift to low-carbon technologies and sustained investment in local infrastructure would create conditions for stronger, future-focused growth.

“This Budget signals the start of a conversation, not the conclusion. The sector requires clarity on how government intends to support priorities like staffing, sustainability and service quality. A coherent approach that aligns fiscal measures with a broader competitiveness plan is essential if hospitality and tourism are to thrive rather than simply manage through continued pressure.”

Steve Alton, BII CEO said:

Steve Alton, BII CEO said:

“Words cannot express how devastating this budget is for so many of our members. We have been working closely with Government, sharing the realities for our members, running vital pub businesses in every community with them.

“Award winning operators, working tirelessly in their local businesses to deliver a brilliant and essential service to their communities, will now face thousands of pounds in increased taxes – and the hard truth is that many of them just will not be able to sustain their businesses come April next year.

“These measures will inevitably force many venues to reduce hours, cut investment, and, most worryingly, cut jobs, with young people set to be hit the hardest. Pubs are one of the UK’s biggest employers of 18–25-year-olds, offering vital first jobs, training, and career opportunities. Today’s Budget threatens these essential employment opportunities in every community.

“The detail behind the headlines of this budget, will put hundreds of community pubs at greater risk, threatening local economies and the social fabric of towns and high streets across the country.

“Government simply must reconsider their position on this or face the huge and dire consequences that we have warned of over the last year, with 35% of independent pubs under threat of closure. Without meaningful support, the consequences will be felt in lost jobs, failed businesses, and weakened communities.”

SBPA President Andrew Lawrence said:

SBPA President Andrew Lawrence said:

“This budget does very little to help Scotland’s pubs or brewers. The increase in beer duty will hit consumers directly, while the rise in the NMW will mean an extra bill of £25m for pubs.

“The sector is already struggling under the strain of high taxes, cost increases, and the cost-of-living crisis impacting on consumer spending habits.

“The changes to business rates in England also mean that without some form of relief in the Scottish Government’s January budget, Scots pubs will continue to face a heavier rates burden that their English counterparts.

“This disparity will drive closures and stifle investment in communities across Scotland. We’re calling on the Scottish Government to use its Budget to set out a permanent fix for this imbalance and to deliver immediate rates relief before more pubs are forced to shut their doors.”