Pubs Regain Share of Dinner Occasions and Drive Higher Spend

According to data from Lumina Intelligence’s Eating & Drinking Out Panel, in 12 weeks ending (12WE) 15/05/2022, pubs had a 13.9% share of total dinner occasions across the eating out market – up +1.3ppts vs. 12WE 20/02/2022.

In the same period, average spend at dinner per consumer was £21.60, and increase of +10% versus the previous period. Spend at dinner is up in the majority of channels, with restaurants seeing an increase of +3% in the latest quarter, however it is pubs that have seen the biggest increase.

These increases are partially driven by high inflation, but also a rise in consumers trading up on less frequent dinner occasions.

Spirits drinkers purchase more and spend more

On average, consumers purchase between 2-3 alcoholic drinks per eating out occasion, whether it is by itself or with food.

Spirits drinkers drink the most drinks per sitting – on average 2.55 drinks per occasion in the 12WE 15/05/2022. This is followed by 2.54 for beer drinkers and 1.97 for wine drinkers. Versus the previous 12 week period, this is a +4% increase for spirits, -1% decline for beer and -2% decline for wine.

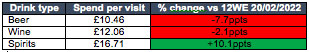

On average, in the 12WE 15/05/2022, alcohol drinkers spend £10.98 on drinks per visit – -3.2% down on the previous 12 weeks (12WE 20/02/2022).

When we analyse this by drink type, we see a decline across both beer and wine, but a +10.1% increase in spend from spirits drinkers:

These differences are being driven in part by the changes in number of drinks consumed, with consumers having slightly fewer beers and wines, but enjoying more spirits. Longer term spend increases will inevitably go up due to price inflation.

Beer still drives the highest volume

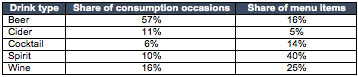

Using Lumina Intelligence’s Eating & Drinking Out Panel, we can see the share of occasions split by alcoholic drink type. Overlaid with Lumina Intelligence Menu Tracker data showing share of menu items split by drinks type, this highlights some interesting data:

Wine and spirits represent two thirds of operator drinks menus, but account for a quarter of consumption occasions. In contrast, beer and cider represent 21% of operator drinks menus and account for 68% of total consumption occasions.

Commenting on the findings, Insight Director at Lumina Intelligence, Blonnie Whist, said:

“Pubs are bouncing back, despite the challenges the sector is facing. Increased spend and regained dinner share are great signs that for high spend occasions which are a bit more special and discretionary, pubs and bars are going to win out. Spirits are becoming a key opportunity for operators to drive frequency and spend, however this cannot be at the expense of beer, which continues to drive the highest volume.”

Find out more about Lumina Intelligence’s Menu Tracker here.