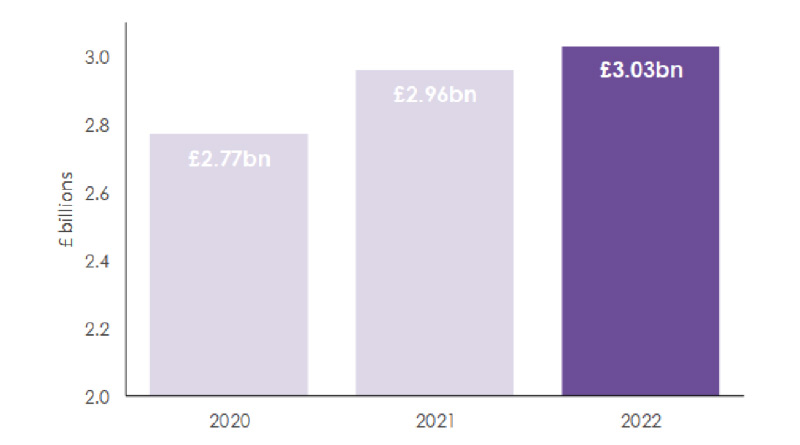

Top 30 UK Restaurant Group Debt Burden Tops £3bn For The First Time

The debt burden of the UK’s Top 30 restaurant groups has broken through £3bn for the first time, shows new research by UHY Hacker Young, the national accountancy group.

Despite the sector’s efforts to cut debt levels, debts increased slightly over in the last year from £2.96bn in 2021 to 3.03bn in 2022 (see graph).

Restaurant companies had built up substantial debts during the last decade as the sector expanded rapidly. With profits in the sector often dependent on scaling chains quickly, many restaurant groups became over-leveraged. Many restaurant companies also added to the borrowing during Covid through BBLs and CBILs loans.

The sharp rise in interest rates over the last two years has substantially added to the strain of servicing that debt.

The rising cost of living is also pushing adding pressure on restaurant operators. Spending on restaurants decreased 10.3% in October 2023, for the ninth consecutive month*.

Peter Kubik, Partner at UHY Hacker Young says:

“The restaurant sector’s debt levels ought to be coming down. It’s worrying that it’s not already, given the cost of borrowing at present.”

“A lot of restaurant groups had worked extremely hard to restructure their debts and shed costs over recent years. These figures suggest that the problem hasn’t been fixed yet.”

“High interest rates and lack of consumer spending are leaving some restaurant chains in a precarious position. If the cost-of-living crisis persists much longer, more restaurants will start to struggle with a lack of cash flow. That’s going to lead to more of them going under.”

Insolvencies of restaurant businesses in the UK rose 44% in the past year, increasing from 1,611 in the year to the end of September 2022 to 2,109 in the following 12 months**.