UK Foodservice Profit Sector Sales Will Surge by 14.9%, Driven by Easing COVID-19 Restrictions, says GlobalData

The UK Government’s strong macroeconomic policies and grants to help businesses, which were severely impacted by COVID-19, will help the country’s foodservice profit sector to grow at a compound annual growth rate (CAGR) of 14.9% from GBP50.5 billion ($69.6 billion) in 2021 to GBP100.9 billion ($152.6 billion) in 2026, predicts GlobalData, a leading data and analytics company.

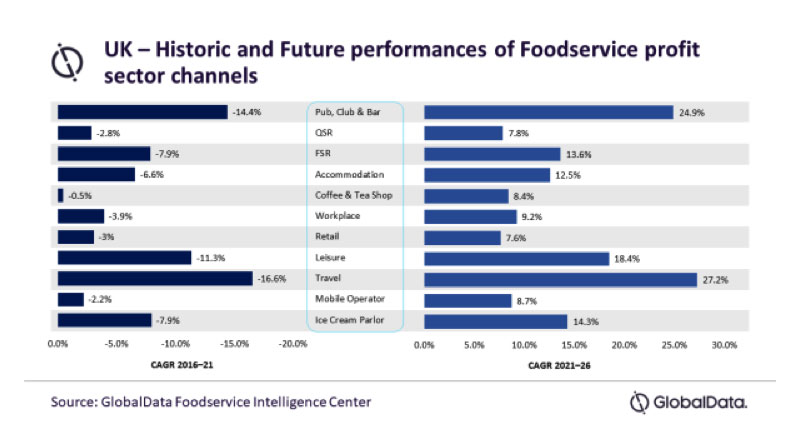

GlobalData’s latest report, “United Kingdom (UK) Foodservice Market Size and Trends by Profit and Cost Sector Channels, Consumers, Locations, Key Players, and Forecast, 2021-2026,” reveals that ‘pub, club & bar’ was the largest foodservice profit sector channel in the UK in 2021 with a value share of 23%. The channel is projected to grow significantly at a CAGR of 24.9% during 2021-26, reflecting the country’s strong culture of socializing over alcoholic drinks.

Quick-service restaurant (QSR) was the second-largest channel, mostly preferred for its convenience, quick and affordable options, and quality. The channel is projected to grow at a CAGR of 7.8% during 2021-26.

Srimoyee Nath, Consumer Analyst at GlobalData, comments :

“A drastic drop in the purchasing power of consumers and restrictions on operations of on-premise channels played a key role in the decline of sales across different profit sector channels during the pandemic. However, with restrictions being lifted and life returning to normalcy, the foodservice sector will revive, especially visible through channels that were most affected.”

The travel channel, which showcased the worst performance during 2016-21 due to stringent lockdown restrictions through most of 2020 and 2021, is anticipated to record the fastest growth at a CAGR of 27.2% during the forecast period. The resumption of tourism activities will provide the primary thrust towards the growth of the channel. Concurrently, all profit sector channels are projected to register growth through 2026.

GlobalData forecasts all foodservice profit sector channels to experience outlet and transaction growth during the forecast period. Chain operators will grow at a higher rate compared to independent operators across restaurant channels.

Nath concludes: “New formats such as cloud kitchens will continue to succeed as convenience will be a key driver in purchase decisions in the coming years.”