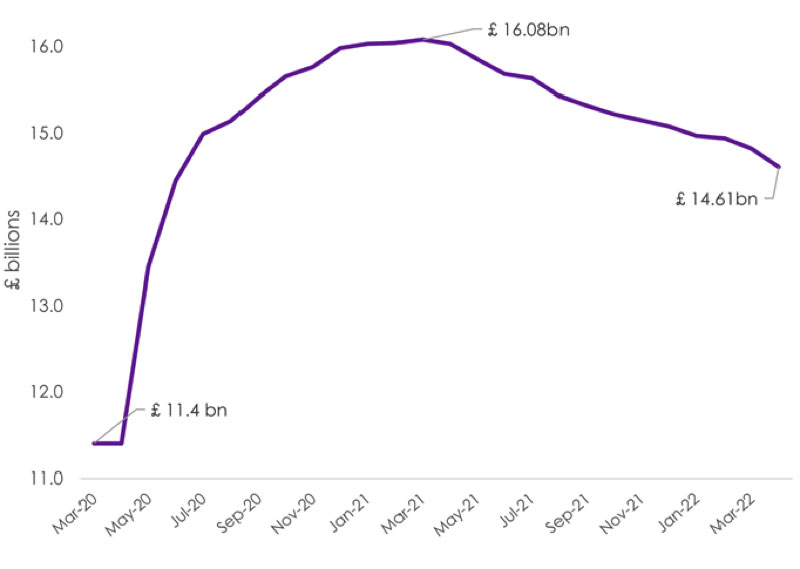

Bank Lending to Hospitality SMEs Falls by £1.4bn Following the End of Coronavirus Loan Schemes

Outstanding bank lending to small businesses in the hospitality sector has fallen by more than £ 1.4billion since the end of CBILS and BBLS loans schemes, dropping to £14.61 billion in April 2022, down from £16.08 billion in March 2021*, says Hazlewoods, Chartered Accountants and Business Advisers.

With the cost of living crisis eating into consumers’ discretionary spending, banks have been less willing to lend to pubs, bars, restaurants and hotels given their perceived higher risk of default.

Some lenders have reduced their lending to the leisure sector following two years that have weakened it significantly through the combined effects of spiralling inflation and repeated closures through lockdown.

Rebecca Copping, Associate Partner at Hazlewoods says:

“Banks are really starting to back away from lending to hospitality businesses. Without financial support from lenders, some pubs, restaurants and hotels are really going to struggle.”

“With a cost of living crisis weakening consumer spending, securing bank lending at viable rates is no easy task for hospitality businesses at the moment.”

Hazlewoods points out that there was also a drop in bank lending to the retail industry of 4.6% in the past 12 months following the end of the Government-supported lending schemes, from £22.1 billion to £21.1 billion. The sector has also seen sales weaken substantially, with a 1.4% rise in sales in April 2022 compared to the previous month**.

Overall bank lending to SMEs fell 3.9%, from £216 billion in March 2021 to £207.5 billion in April 2022, with bank reluctance to lend making it tougher for businesses to secure finance.

Hazlewoods says that the Government’s new Recovery Loan Scheme (RLS) is markedly less generous than the CBILS and BBLS schemes it replaced, meaning banks are less keen to lend to SMEs through it. Under RLS the Government no longer pays the first 12 months interest on behalf of businesses, nor the lender’s fees, while interest rates for borrowers have also risen.

Under the RLS the Government guarantee to a lender is only 80% of the amount loaned to a business, making them significantly higher-risk for banks to write than under the 100% Government-guaranteed CBILS and BBLS schemes.

Adds Rebecca: “The Recovery Loans Scheme that has replaced CBILS and BBLS is much less attractive for banks – that has impacted the level of risk they are willing to take.”

“SMEs planning for the end of their CBILS and BBLS loan terms may find that they struggle to refinance their debts at rates that work for them.”

Bank lending to hospitality SMEs falls since the end of the CBILS and BBLS loan schemes: