Mayor Of London Considering A ‘Tourist Tax’ For London And Will ‘Follow Evidence’

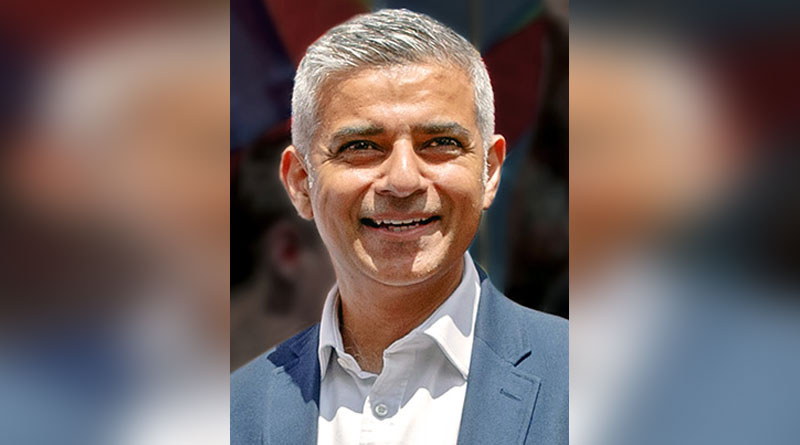

London mayor Sadiq Khan is believed to be considering a tourist tax in London’s hotels despite warnings from the hospitality sector that it would be ‘extremely damaging’ for businesses.

During a discussion at the Centre for London thinktank’s annual conference he said: “I’m happy to look into where it’s worked, what the issues are in relation to that particular policy… we’ll be looking at what cities are doing not just across Europe, but in the UK as well.”

Existing levies across Europe vary depending on the city and quality of accommodation. Visitors to Barcelona, staying in a four-star hotel pay a levy of €4.95 per night as part of their bill, and in Paris would pay a levy of €8.13 per night.

In an effort to reduce the number of visitors to Venice a €5 charge will be introduced next year for day-trippers to the city.

However, it seems unlikely a tax will be introduced imminently, the mayor added: “Let’s wait and see what the evidence is. I’m somebody who believes in following the evidence.”

He added that his team would be examining evidence from other cities, including Manchester, where a levy of £1 per room, per night, plus VAT, was introduced in April 2023.

If introduced in London, the tax is likely to be a fixed-price, per-night levy added to the price of every night booked in accommodation in the capital by overseas visitors.

Kate Nicholls, chief executive of UKHospitality, said:

“London remains one of the biggest visitor destinations in the world, but the number of inbound visitors to the capital hasn’t yet returned to pre-pandemic levels.”

She said the UK “ranks poorly” in the global competition for tourists a high VAT rate, adding: “The introduction of a tourist tax would only damage that further.”

Earlier this year the board of the Bournemouth Christchurch and Polle (BCP) Accommodation Business Improvement District (ABID) voted to delay aa proposed £2-per-night visitor charge, which was set to be enforced from 1 July.

The delay came after a group of 42 hoteliers lodged an appeal with the Secretary of State, claiming that many of the 75 owners of eligible hotels were either unable to vote or unaware of a ballot on the levy.