Wine Drinkers Facing a Super Stealth Tax when Alcohol Duty Goes up in August

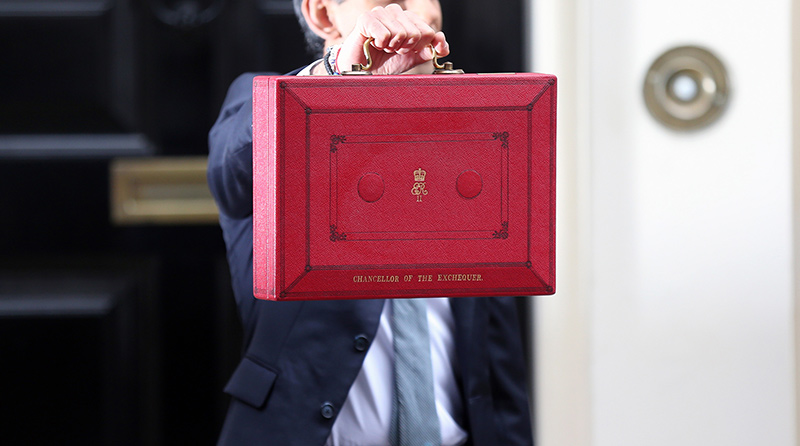

Wine drinkers face rocketing prices if the Chancellor goes ahead with a double pronged tax hike, likely to be announced at the Spring Budget.

When the Government’s new alcohol duty regime comes into force on August 1st 2023 – which will broadly tax alcohol according to strength – some 90% of all still wine is set to see at least a 9% duty rise.

However, if the Chancellor, Jeremy Hunt, announces that the freeze to alcohol duty will also end on August 1 and chooses to increase duty by inflation – for example 10% RPI* – wine drinkers will face a tax hike at least double that size.

A 20% tax rise will mean that duty on a bottle of still wine will go up by a staggering 44p. For fortified wines the duty rises will be even greater with port set to rise by £1.29 a bottle.

Wine drinkers are facing the biggest single increase in almost 50 years.

Ironically this will stoke the inflation that the Prime Minister has insisted his government must seek to control.

These crippling inflationary tax hikes will not help cash-strapped consumers, who are already struggling with a cost of living crisis.

Wine businesses have repeatedly raised their concerns with the Treasury that the new tax rates unfairly target wine drinkers and will make the UK market a less attractive place to sell wine.

And it’s not just limited to wine, because spirits – already the highest taxed alcoholic drink – also received a 10% increase adding a further 75p to a bottle of vodka.

History has shown that freezing duty does not have a negative impact on Treasury revenues.

Miles Beale, Chief Executive of the Wine and Spirit Trade Association said:

“The UK’s 33 million wine drinkers are blissfully unaware that the price of wine is set to rocket this summer. If the Chancellor goes ahead with a two-pronged attack on wine drinkers by adding an inflationary duty increase on top of the stealth tax already applied when the Government’s new alcohol duty regime kicks in this summer, duty alone will add 44p to a bottle of still wine.

If alcohol duty rates went up by RPI, this will be a crippling blow to the UK alcohol industry and consumers who will have to pay the price for tax rises during a cost-of-living crisis.”